The Ultimate Source for Anyone Thinking About Offshore Company Formation Techniques

Offshore Company Formation offers a strategic chance for entrepreneurs looking for to broaden their company perspectives. Comprehending the nuances of developing a legal entity abroad is crucial. From picking the ideal jurisdiction to maneuvering intricate tax obligation landscapes, there are numerous aspects to consider. This source intends to light up the procedure while highlighting crucial advantages and compliance needs. As the journey unfolds, the implications of these selections end up being progressively substantial, prompting more exploration right into efficient methods.

Understanding Offshore Company Formation

Why do entrepreneurs think about offshore Company Formation as a practical method? This question reflects the growing rate of interest in developing companies in international jurisdictions. Offshore Company Formation includes establishing a lawful business entity outside the entrepreneur's home country. Entrepreneurs are attracted to this technique for different factors, including regulative advantages and enhanced privacy. They look for beneficial tax routines, structured conformity processes, and the potential for asset protection.Understanding overseas Company Formation needs experience with the legal frameworks and needs of various jurisdictions. Each nation uses special rewards and difficulties, making it vital for business owners to carry out extensive research study. Trick factors include the convenience of incorporation, ongoing compliance commitments, and the political security of the chosen location. Entrepreneurs need to also think about global legislations and treaties that may affect their organization procedures. Generally, comprehension of overseas Company Formation lays the foundation for informed decision-making in a globalized economy.

Trick Benefits of Offshore Firms

Offshore companies provide a number of benefits that interest entrepreneur and investors alike. Secret advantages consist of tax optimization strategies that can substantially decrease obligations, asset security actions that safeguard wide range from potential cases, and boosted privacy methods that guarantee privacy. Understanding these advantages is essential for anyone considering the Formation of an overseas entity.

Tax Optimization Approaches

Possession Protection Conveniences

Establishing an overseas Company not just supplies tax optimization yet likewise provides significant property security benefits. Offshore entities can work as an obstacle versus legal insurance claims, financial institutions, and political instability in the owner's home nation. By holding possessions in an international jurisdiction, people can protect their wealth from legal actions and prospective confiscation. Additionally, several overseas jurisdictions have regulations that favor the security of company assets, making it difficult for financial institutions to access them. This strategic placement of properties can enhance monetary safety and security and give assurance. The legal frameworks connected with offshore business often enable for better control over possession administration, making sure that proprietors can guard their financial investments effectively. Overall, asset security stays a compelling reason to evaluate overseas Company Formation.

Improved Privacy Procedures

Just how can people effectively protect their monetary privacy in a progressively transparent world? Offshore companies provide a viable solution by offering enhanced privacy steps that shield the identifications of their proprietors. Lots of territories permit for candidate services, where 3rd parties are selected to act on part of the actual owners, therefore securing their names from public documents. Additionally, offshore entities usually gain from strict information defense regulations, making sure that delicate details stays private. Using offshore savings account connected with these companies better safeguards monetary transactions from spying eyes. Individuals looking for to keep discretion in their financial events find offshore Company Formation an effective technique for boosted personal privacy and safety and security.

Choosing the Right Territory

Selecting the suitable jurisdiction is important for any person thinking about offshore Company Formation, as it can significantly influence tax responsibilities, regulative requirements, and total business procedures. When making this decision, various factors must be assessed (offshore company formation). Tax rewards, such as reduced business tax obligation rates or tax obligation vacations, can significantly boost earnings. Additionally, the political stability and economic setting of a territory are crucial, as they impact service protection and growth potential.Moreover, the ease of operating, including the efficiency of Company enrollment procedures and the availability of specialist services, must be thought about. Some jurisdictions are known for their robust banking facilities, while others may supply privacy advantages that are attractive to entrepreneur. Eventually, a thorough evaluation of these elements will lead individuals in selecting a territory that straightens with their functional goals and risk resistance, ensuring a critical structure for their overseas endeavors

Regulative and legal Conformity

Recognizing the governing and legal structure of the chosen jurisdiction is critical for effective overseas Company Formation. Compliance with neighborhood regulations assurances that the Company operates legally and prevents prospective lawful issues. Each jurisdiction has its own collection of regulations, ranging from registration needs to ongoing coverage obligations.Certain territories may mandate details licensing, while others concentrate on anti-money laundering (AML) legislations and due persistance steps. Business have to additionally recognize their responsibilities regarding shareholder and supervisor details, which might need to be disclosed to authorities.Failure to abide by these lawful stipulations can cause fines, charges, or perhaps the dissolution of the Company. Therefore, seeking advice from legal and conformity experts is necessary to browse these complexities efficiently. By establishing a strong foundation in compliance, organizations can delight in the advantages of overseas consolidation while reducing threats connected with non-compliance.

Tax Considerations and Ramifications

Tax obligation considerations play a crucial role in the decision-making process for overseas Company Formation. By comprehending the prospective offshore tax obligation advantages, organizations can tactically position themselves to maximize their economic results. Compliance with international guidelines remains important to prevent lawful difficulties.

Offshore Tax Obligation Perks

Various individuals and services explore overseas Company Formation largely for the considerable tax benefits it can give. Offshore jurisdictions often supply lower tax obligation rates or even absolutely no taxes on specific sorts of revenue, making them eye-catching for riches preservation and growth. This can consist of lowered corporate tax prices, exemptions on capital gains, and the absence of inheritance tax obligation. Additionally, overseas business can assist organizations and individuals enhance their tax obligation obligations through calculated preparation and the utilization of double tax treaties. These website advantages can enhance capital and profitability, enabling reinvestment or repatriation of funds without too much tax concerns. Comprehending these benefits is essential for anyone considering offshore Company Formation as part of their monetary method.

Conformity and Rules

While overseas Company Formation uses eye-catching tax obligation advantages, it is just as important to browse the conformity and regulatory landscape that accompanies such plans (offshore company formation). Several territories enforce rigorous policies relating to coverage and monetary disclosures, requiring companies to maintain openness. Failure to comply can result in extreme fines, consisting of hefty penalties or perhaps dissolution of the Company. Additionally, tax obligation treaties and international arrangements demand careful factor to consider of tax obligation responsibilities in both the offshore jurisdiction and the individual's home nation. Services need to also remain updated on developing regulations, as governments significantly look at offshore tasks. Consequently, specialist guidance is essential to guarantee adherence to all lawful requirements and to optimize the advantages of offshore Company Formation

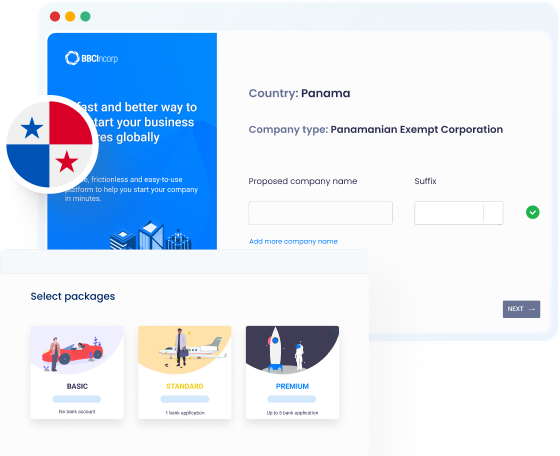

Actions to Establish Your Offshore Company

Establishing an overseas Company includes a series of systematic steps that can streamline the procedure and make the most of benefits. Individuals have to select the proper territory that aligns with their service objectives, thinking about variables such as tax obligation benefits, privacy, and regulative setting. Next, they ought to pick an ideal service structure, such as a limited obligation Company or company, which will affect responsibility and taxation.Once the framework is figured out, the needed documentation has to be prepared, including write-ups of consolidation and recognition for supervisors and investors. Following this, the individual need to open a savings account in the selected jurisdiction to assist in economic operations.Finally, it's crucial to follow local policies by acquiring needed licenses or authorizations and ensuring ongoing conformity with reporting responsibilities. By adhering to these steps, business owners can effectively establish their overseas service and setting it for success.

Preserving Your Offshore Entity

Maintaining an overseas entity calls for cautious attention to numerous compliance and operational facets. Routine filing of necessary files, such as monetary statements and yearly returns, is vital to stick to the territory's laws. Failure to abide can cause fines or loss of the entity's status.Additionally, keeping precise and upgraded records is important for transparency and audit purposes. Offshore entities often call for a neighborhood registered representative to meet legal obligations and promote communication with authorities.Tax compliance is another considerable facet; comprehending the tax obligation ramifications in both the overseas territory and the home country assurances that the entity operates within legal frameworks.Lastly, routine review of the entity's framework and operations can enhance its advantages. By staying educated and positive, owners can efficiently manage their overseas entities and maximize their tactical benefits.

Regularly Asked Questions

Can I Open Up a Savings Account for My Offshore Company Remotely?

Lots of individuals inquire whether it is possible to open up a checking account for an offshore Company remotely. Generally, this is possible, but demands vary by territory and particular financial institution plans should be complied with as necessary.

What Are the Typical Misconceptions About Offshore Firms?

How Do Offshore Companies Secure Versus Political Instability?

Offshore firms can alleviate dangers related to political instability by diversifying assets in stable jurisdictions, providing lawful securities, and making it possible for versatile financial monitoring. This approach assists secure financial investments against damaging political developments in their home countries.

Are There Any Limitations on Possession for Offshore Companies?

Limitations on possession for overseas companies differ by jurisdiction. Some countries enforce limitations on foreign possession or need local directors, while others offer complete flexibility. Prospective proprietors must completely research study particular regulations in their selected location.

Exactly How Can I Ensure My Offshore Company Remains Anonymous?

To guarantee privacy for an overseas Company, people can utilize nominee services, establish depends on, and select territories with strict personal privacy legislations. Consulting legal experts is necessary to keep and browse policies privacy efficiently. They seek beneficial tax obligation programs, structured compliance procedures, and the capacity for possession protection.Understanding offshore Company Formation calls for experience with the legal frameworks and needs of different territories. Furthermore, offshore business can promote efficient revenue repatriation via numerous structures, such as holding business or global trading entities. Selecting the proper territory is essential for anybody taking into consideration overseas Company Formation, as it can greatly affect tax obligations, governing needs, and total business operations. Various people and businesses discover overseas Company Formation primarily for the considerable tax obligation benefits it can offer. Offshore entities commonly need a neighborhood authorized representative to satisfy lawful obligations and help with interaction with authorities.Tax conformity is an additional considerable aspect; recognizing the tax obligation implications in both the offshore jurisdiction and the home nation warranties that the entity operates within legal frameworks.Lastly, periodic evaluation of the entity's framework and operations can enhance its advantages.

Comments on “Easy-to-Follow Offshore Company Formation for Startups”